CD Special

Our 24-Month CD* keeps your money on the up and up and UP...

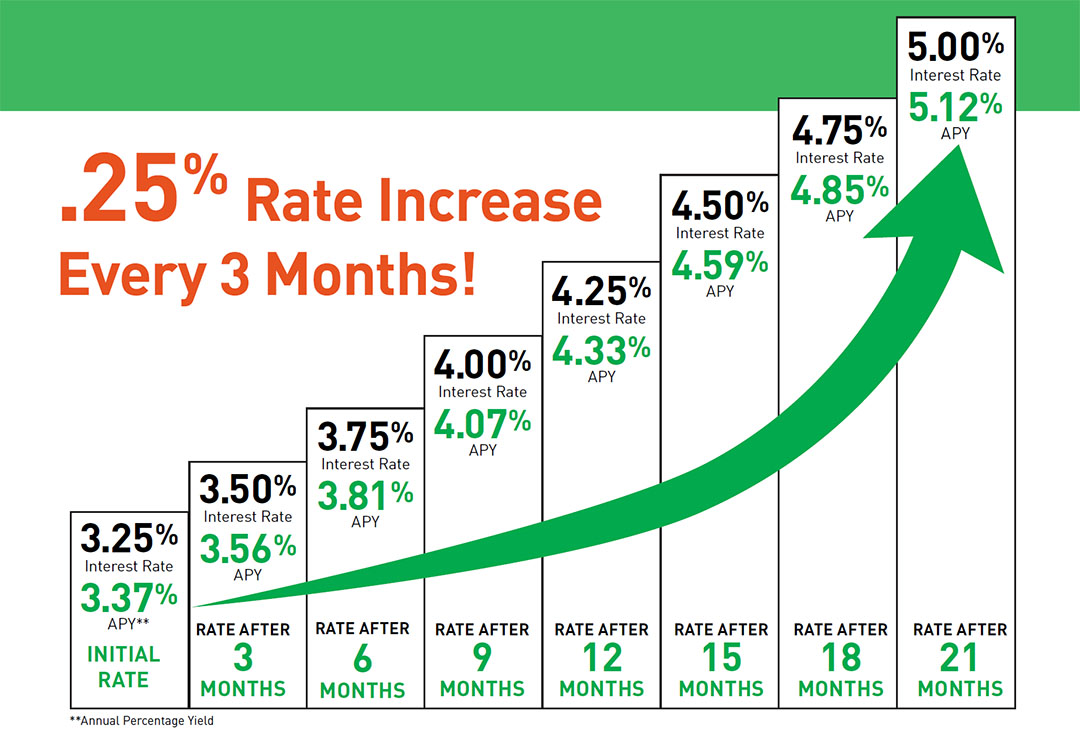

.25% Rate Increase Every 3 Months!

-

-

-

- New Money Only

- Must have a Checking Account with Direct Deposit(s) totaling at least $2,000/month

- Minimum balance to open: $5,000

- You may deposit more money into this CD during the first 6 months after opening

-

-

To open an account or learn more,

visit a GSB Branch today.

Or call us to learn more:

888-324-3191

*RATE INFORMATION. Effective 07/03/2024. The interest rate on your account for the first 3 months will be 3.25%; for the second 3 months will be 3.50%; for the third 3 months will be 3.75%; for the fourth 3 months will be 4.00%; for the fifth 3 months will be 4.25%; for the sixth 3 months will be 4.50%; for the seventh 3 months will be 4.75%; and for the eighth 3 months will be 5.00%; with an average rate of 4.125% and a corresponding APY of 4.20%. You will be paid these rates and the corresponding annual percentage yield until maturity.

ASSOCIATED ACCOUNT REQUIREMENTS. Every account created under this agreement must have an associated Demand Deposit Account (DDA) (i.e. a checking account). Also, there must be direct deposit(s) of no less than $2,000 per month into the DDA account. If the direct deposit requirement is not met at any time prior to the maturity date, the rate in effect at the time the deposit(s) cease will be ‘locked’ until the direct deposit resumes. Fees may reduce earnings.

FREQUENCY OF RATE CHANGE. The interest rate will change every 3 months until maturity.

COMPOUNDING AND CREDITING. Interest will be compounded monthly and will be credited to the account monthly.

The annual percentage yield assumes interest will remain on deposit until maturity. A withdrawal will reduce earnings. If you close your account before interest is credited, you will not receive the accrued interest.

MINIMUM BALANCE REQUIREMENTS. You must deposit $5,000.00 to open this account. This deposit must come from funds not already held in any form by Greenfield Savings Bank. You must maintain a minimum daily balance of $10.00 in the account each day to obtain the disclosed annual percentage yield. You will earn interest for every day during the period that your account equals or exceeds the minimum daily balance requirement.

BALANCE COMPUTATION METHOD. We use the daily balance method to calculate interest on your account. This method applies a daily periodic rate to the principal in the account each day.

ACCRUAL ON NONCASH DEPOSITS. Interest begins to accrue on the business day following the banking day you deposit non-cash items (for example, checks).

TRANSACTION LIMITATIONS. You may deposit funds for the first six months only. Any deposits after opening must come from funds not already held in any form by Greenfield Savings Bank. You can only withdraw interest credited in the term before maturity of that term without penalty. You can withdraw interest anytime during the term of crediting after it is credited to your account.

WITHDRAWAL OF INTEREST PRIOR TO MATURITY. The annual percentage yield assumes interest will remain on deposit until maturity. A withdrawal will reduce earnings.

MATURITY DATE. Your CD will mature 24 months after opening.

EARLY WITHDRAWAL PROVISIONS. We will impose a penalty if you withdraw any or all the deposited funds before the maturity date. The fee imposed will equal 12 months of interest. Up to 4 withdrawals may be made without penalty, on the day the rate changes, every 3 months before the 24-month maturity. In certain circumstances, such as the death or incompetence of an owner of this account, the law permits, or in some cases requires, the waiver of the early withdrawal penalty.

RENEWAL POLICIES. Your account will automatically renew at maturity. You will have a grace period of 5 business days after the maturity date to withdraw the funds in the account without being charged an early withdrawal penalty.

The renewal will be for 24 months. The interest rate will be the same as we offer on new time deposits on the maturity date which have the same term, minimum balance (if any) and other features as the original time deposit.

You may prevent renewal if you withdraw the funds in the account at maturity or we receive written notice from you (within the grace period). We can prevent renewal if we mail notice to you at least 30 calendar days before maturity. If either you or we prevent renewal, your deposit will be placed in an interest-bearing account.

ADDITIONAL INFORMATION REGARDING YOUR ACCOUNT. No interest will be paid for the period following maturity on any part of the deposit if withdrawn within 5 business days after maturity. Any fees assessed may reduce earnings.

LEVY FEES. A fee of $20.00 may be assessed for services rendered due to State or Federal levies.